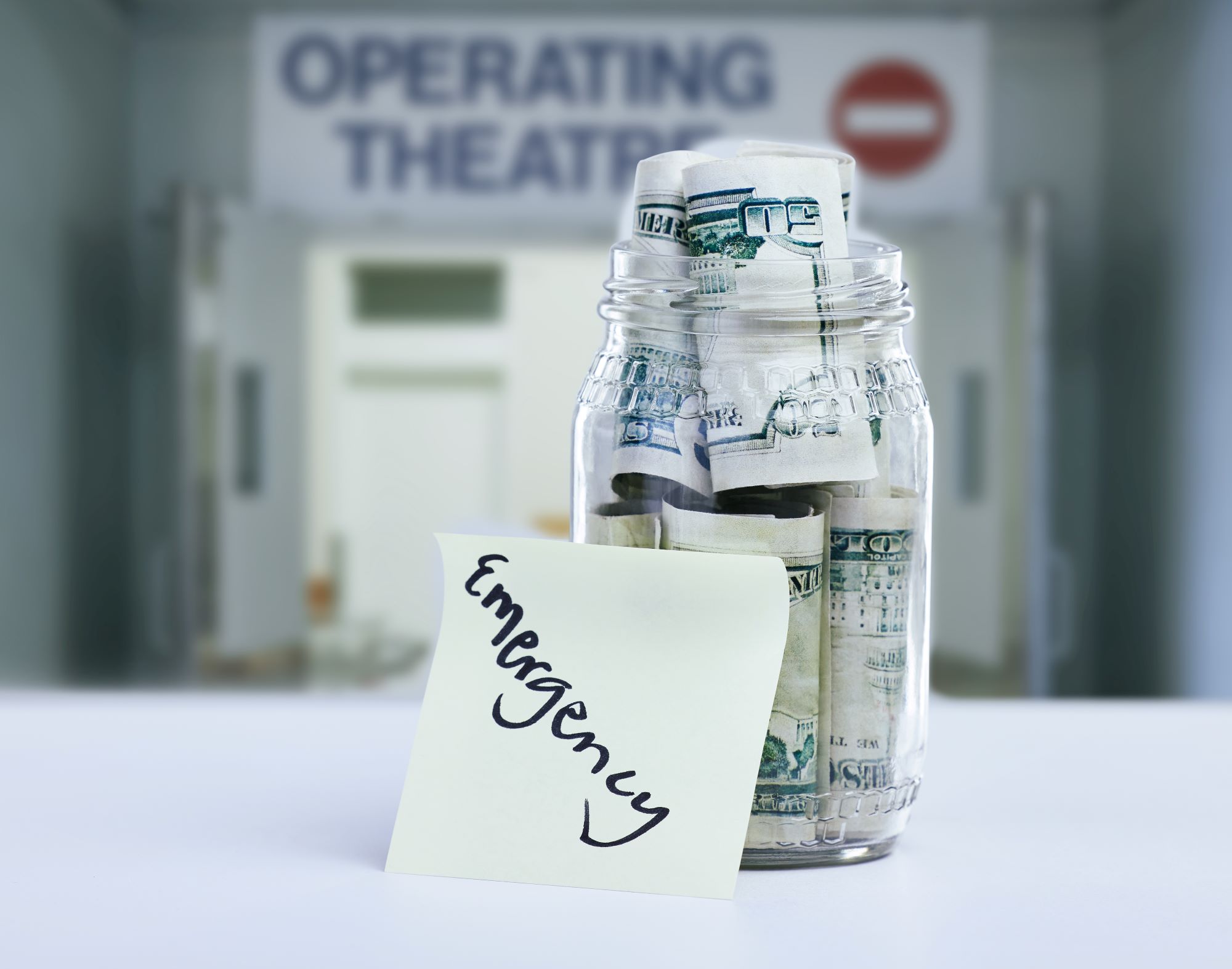

Financial experts recommend that individuals aim to save between three to six months’ worth of living expenses to cushion against unforeseen financial shocks such as job loss, medical emergencies, or urgent home repairs. However, for many, starting an emergency fund from zero remains a daunting challenge.

Why Start from Zero?

Many individuals may find themselves in precarious financial situations due to student loans, credit card debt, or rising living costs. According to a recent report from the Federal Reserve, approximately 40% of Americans would struggle to cover a $400 emergency expense. This statistic underscores the urgent need for accessible strategies to help individuals initiate their savings journey effectively.

Establishing Financial Priorities

The first step in building an emergency fund from scratch is to assess your current financial situation. This includes understanding your income, expenses, and any outstanding debts. A clear budget helps identify areas where spending can be reduced, freeing up funds to allocate toward savings. Financial advisors often suggest the 50/30/20 rule, which allocates 50% of income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment.

Once you understand your financial landscape, aimed savings targets can be formulated. For instance, if your average monthly expenses total $3,000, your initial goal should be to save at least $3,000 to establish a complete emergency fund.

Choosing the Right Savings Account

Selecting the right type of account for your emergency fund is crucial to ensure that your savings are both accessible and interest-bearing. High-yield savings accounts or money market accounts typically offer higher interest rates than traditional savings accounts, making them ideal for growing an emergency fund while keeping funds liquid for immediate access. According to Bankrate, as of October 2023, average annual percentage yields (APY) on high-yield savings accounts are around 4.5%, which can significantly enhance your savings over time.

Automating Your Savings

One of the most effective ways to build an emergency fund is to automate savings. Setting up automatic transfers from your checking to your savings account after each paycheck can create a “pay yourself first” mentality. Even small amounts can accumulate over time; for example, saving just $50 a week can lead to a $2,600 annual contribution. Financial experts underscore that consistency is key, as regular deposits, regardless of the amount, can foster a positive savings habit.

Supplementing Your Income

In addition to cutting unnecessary expenses, consider exploring supplementary income opportunities to accelerate your savings growth. Side hustles, freelance opportunities, or part-time jobs can provide significant additional income that can be directly channeled into your emergency fund. According to a study by Upwork, nearly 36% of the U.S. workforce is engaged in freelance work, showing that alternative income sources are increasingly part of the modern economy.

Market Impact on Savings Rates

The current economic environment can influence savings behavior. Rising interest rates, such as those recently implemented by the Federal Reserve, have led to increased yields on savings accounts, making saving more attractive. The U.S. personal savings rate, which was notably high during the pandemic, has shown some fluctuations but remains a vital component of financial resilience. Economists predict that as inflation stabilizes, the personal savings rate may level out, emphasizing the necessity for individuals to solidify their emergency funds while interest rates remain favorable.

Expert Opinion

Financial planner and author Jane Doe emphasizes that the journey to building an emergency fund can be a transformative financial experience. “The psychological relief that comes from knowing you have a financial safety net is invaluable,” she states. Altogether, cultivating a habit of saving, no matter how small, can lay the groundwork for greater financial health in the long run.

What’s Next?

Starting an emergency fund from zero requires diligence, financial understanding, and strategic planning. By prioritizing savings, choosing suitable accounts, and striking a balance between income and expenses, individuals can feasibly build a substantial emergency fund. As economic conditions evolve, maintaining an adaptable savings strategy will be critical. Ultimately, the goal is to create a financial buffer that not only supports individual wellbeing but also fosters long-term financial stability.