Nvidia (NVDA) stock saw modest movement Thursday amid reports that President Trump’s administration will repeal a key Biden-era restriction on AI chip exports, sparking both investor relief and market uncertainty.

The Commerce Department confirmed the regulatory reversal late Wednesday, saying the AI diffusion rule, set to take effect this month, was “overly complex” and would be replaced by a simpler rule designed to promote U.S. AI dominance.

What Was the AI Diffusion Rule?

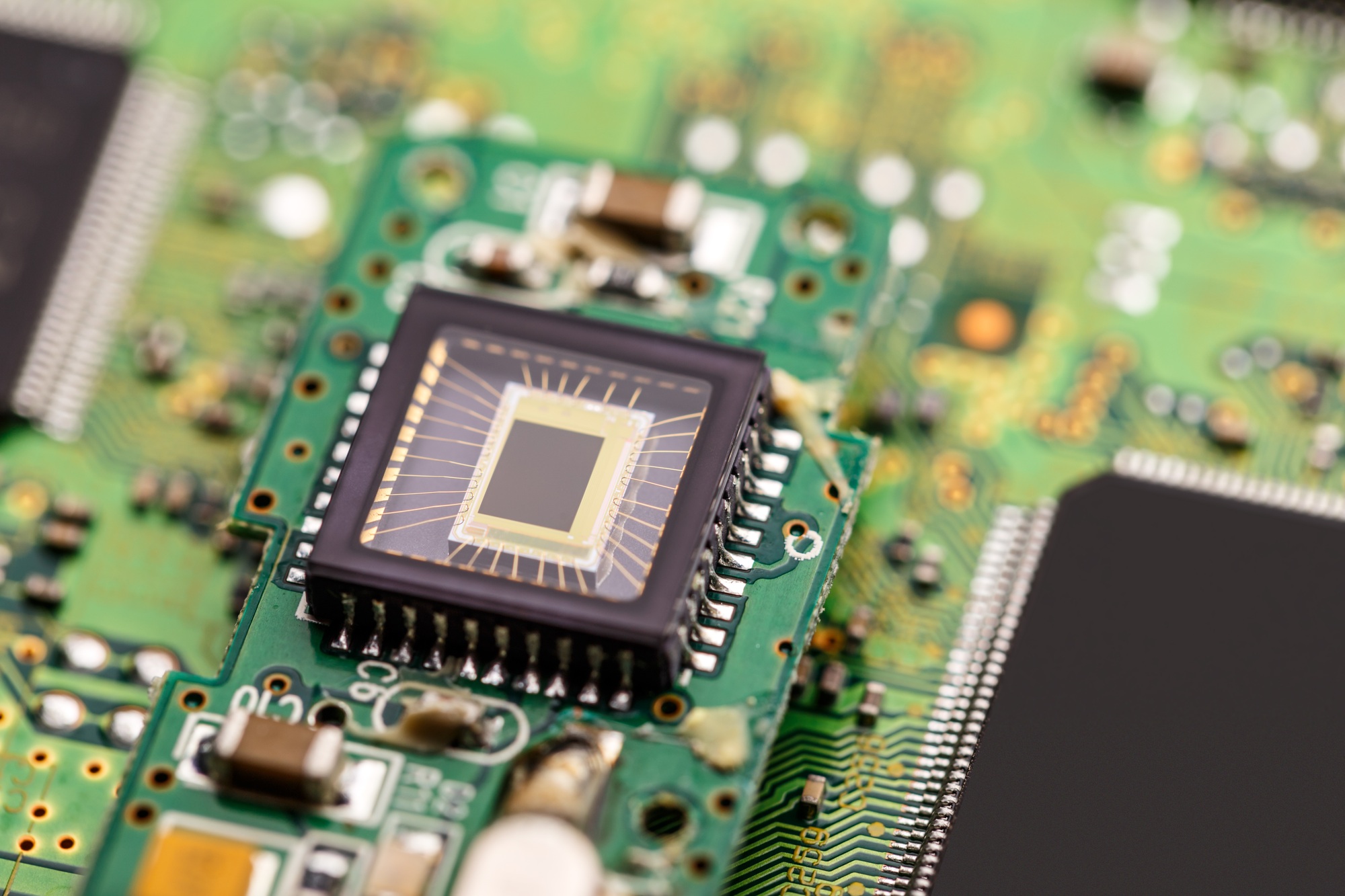

Implemented in the final days of the Biden administration, the AI diffusion rule capped exports of advanced AI chipsbased on a tiered system to prevent indirect smuggling to China via third-party nations. It also restricted expansion of U.S.-based AI data centers overseas, frustrating American chipmakers and tech giants reliant on global infrastructure.

Nvidia, the dominant player in AI hardware, and competitor AMD (Advanced Micro Devices), had both publicly opposed the regulation. Nvidia’s VP of government affairs, Ned Finkle, had criticized the rule as a mechanism to “rig market outcomes and stifle competition.”

How Did Nvidia and AMD React?

Nvidia shares rose 3% on Wednesday following Bloomberg’s initial report and saw a brief spike of 1.4% early Thursday, before ending the day mostly flat. AMD, meanwhile, closed 1.3% higher, building on a 2% gain the previous day.

The tempered reaction reflects investor caution. While the rollback of export curbs is seen as a positive for chipmakers, it comes amid broader market volatility caused by Trump’s trade war and uncertain details about what the new AI policy will actually entail.

Industry Still Faces Headwinds

Nvidia and AMD have suffered double-digit losses in 2025, down around 13% and 17% respectively, due in part to Trump’s tariffs on Chinese imports and chip export restrictions earlier this year. The repeal of the AI diffusion rule may ease some pressure, but analysts caution it won’t fully reverse the broader regulatory overhang facing chipmakers.

Trump has signaled a more nationalistic and deregulatory approach to tech, but lack of policy clarity continues to weigh on sentiment. While chip firms are hopeful about renewed export flexibility, they still face geopolitical risks, rising competition from abroad, and ongoing regulatory scrutiny.