Nvidia’s stock surged on Friday, closing at $135.40 and notching one of its strongest weekly performances this year. The gain, which pushes Nvidia’s weekly rise close to 16%, comes amid renewed investor optimism around the company’s AI chip dominance and fresh signals of its strategic push into China despite growing geopolitical headwinds.

AI chip demand keeps momentum alive

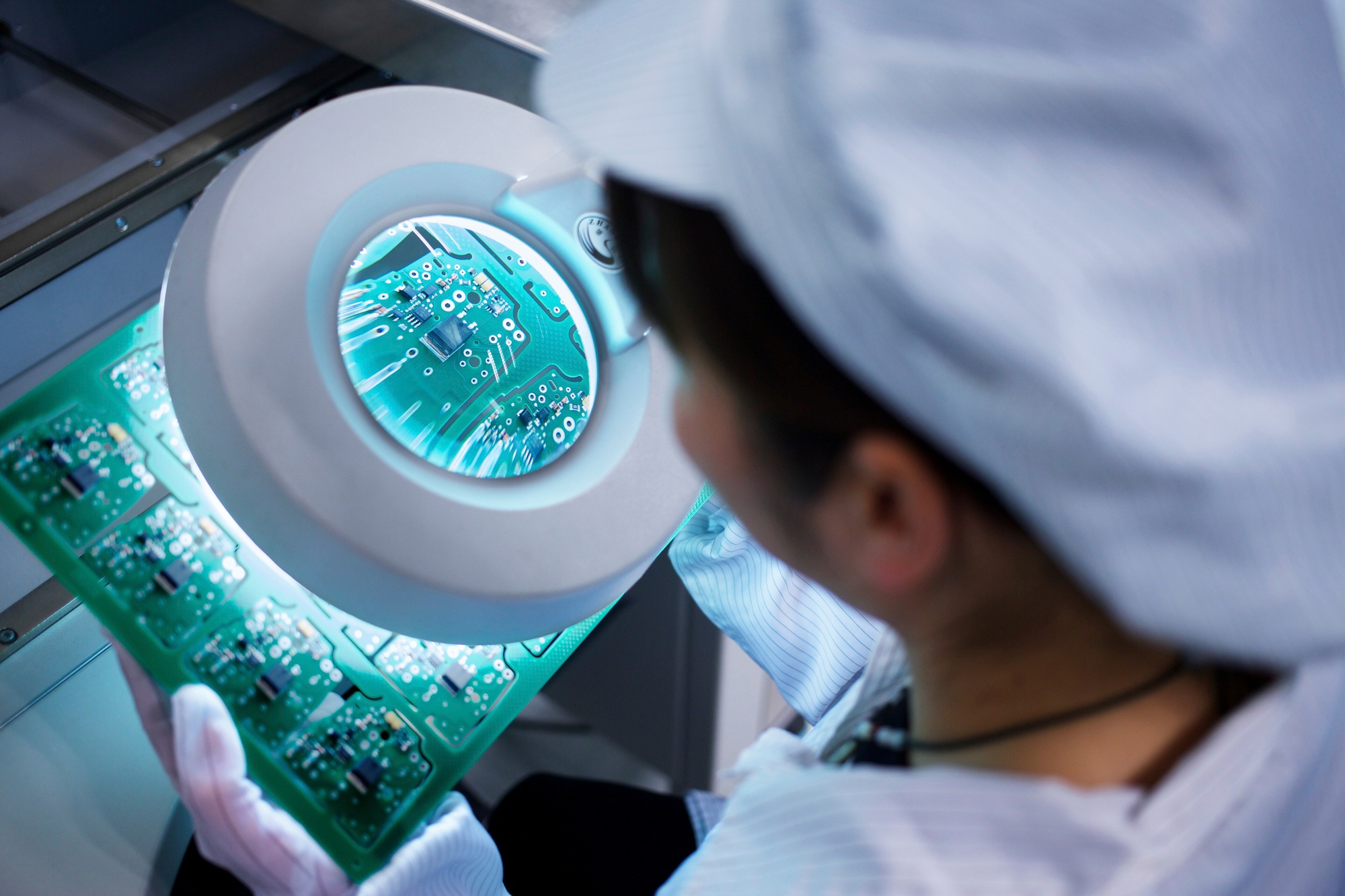

At the center of Nvidia’s latest rally is continued demand for its industry-leading artificial intelligence chips. These chips, used in everything from data centers to autonomous vehicles, have been central to the broader AI infrastructure buildout, especially among U.S. tech giants and global cloud providers.

Over the past year, Nvidia has maintained its position as the go-to supplier for high-performance GPUs, with its H100 and upcoming B100 series reportedly sold out through multiple quarters. The company’s role in enabling generative AI workloads and large language models has been key to its dominance, and this week’s market action reflects renewed enthusiasm ahead of its upcoming earnings release.

Strategic expansion into China

One of the biggest drivers of the latest move came from reports that Nvidia is looking to open a new research and development hub in Shanghai. While official confirmation is pending, the reported initiative signals Nvidia’s intention to deepen its footprint in China despite the challenges posed by U.S. export controls and trade restrictions.

China remains a massive market for Nvidia, particularly in data center and enterprise sectors. In recent quarters, tightened U.S. government rules limited Nvidia’s ability to sell some of its most powerful chips to Chinese firms. However, Nvidia has adapted by designing modified chips that comply with export regulations while still serving Chinese demand.

The planned R&D expansion would support long-term talent acquisition and product development tailored for regional needs—suggesting that Nvidia sees strategic value in remaining embedded in the Chinese ecosystem.

Analyst views and investor reaction

Analysts were quick to respond to the developments. Several research firms upgraded Nvidia’s stock outlook, citing not only the robust AI demand pipeline but also the company’s ability to adapt to complex regulatory landscapes.

One analyst noted that Nvidia’s moves show “a proactive approach to maintaining relevance in global markets, especially where policy challenges are high but market opportunity remains too large to ignore.” That sentiment appeared to resonate with institutional investors, as trading volumes spiked mid-week in parallel with the company’s upward move.

Earnings on deck

Nvidia is set to report quarterly earnings next week, and expectations are high. Market watchers will be focused not just on revenue and profit, but on forward guidance—particularly regarding chip supply, new product timelines, and international revenue distribution.

There’s also speculation that Nvidia may offer updates on its foundry partnerships and long-term product roadmap, especially around the rollout of its next-generation chips, which could further cement its leadership in AI hardware.

Caveats remain

Despite the strong rally and optimistic sentiment, some analysts warn that Nvidia’s valuation remains lofty. With the stock trading at over 60 times forward earnings, there’s little room for error if revenue growth slows or if broader economic conditions tighten.

Geopolitical risks, especially regarding U.S.–China relations, could also cloud the longer-term outlook. The potential for new export curbs or licensing restrictions remains a wildcard that investors are carefully watching.

What’s next

All eyes now turn to Nvidia’s earnings report next week. If the company delivers another quarter of revenue growth and clear signals of international expansion, particularly in regulated markets like China, the current rally could extend further.

For now, Nvidia’s ability to lead in AI innovation while navigating policy and market challenges is driving renewed confidence—and lifting its stock to fresh 2025 highs. Whether that trend holds depends largely on how well Nvidia balances innovation, regulation, and international strategy in the quarters ahead.